The following income categories are exempt from income tax. Sec 13 1 a any wages salary remuneration leave pay fee commission bonus gratuity perquisite or allowance whether in money or otherwise in respect of having or exercising the employment.

Comparehero The Comparehero Guide To Purchasing Property In Malaysia Borneo Post Online

C Taxed under Section 131a of the ITA.

. Perquisites can be received regularly or casually. Perquisites can be received regularly or casually. Perquisites have the following characteristics.

Paragraph 13 1 b of Schedule 6 of the Income Tax Act 1967 which provides for incomes of religious institutions to be exempted from income tax that was passed by Parliament under the. Advertisement taxes are inevitable but if you are educated you can. All you need to know here.

RM 10000 x 12 x ⅓ RM 40000. Income Declared Under Section 13 1 a RM 120000 2. 52 All perquisites are gross income under paragraph 131a of the ITA and are chargeable to tax under section 4b of the ITA.

13 1 a salary wages remuneration leave pay fees commission bonus gratuity gifts testimonial payments perquisite or allowances s. Perquisites have the following characteristics. In the united states every working person who earns more than a certain amount of money each year needs to pay income taxes to the federal government.

30 of Gross Employment Income under Section 13 1 a RM 6000 x 12 months x 30 no apportionment of ⅓ for this. B Paid to recognize the past services rendered by an employee. The Finance Bill 2021 has been passed with some amendments and the MOF has issued a media release dated 30 December 2021 on the amendments and subsequently the.

Payments which are not in respect of taxpayers services to the company are not. All perquisites are gross income under paragraph 131a of the ITA 1967 and are chargeable to tax under subsection 4b of the ITA 1967. Annual Defined Value of Living Accommodation.

The amount of employment income declarable is calculated as follows. He is required to withhold tax on payments for services renderedtechnical advicerental or other payments made under. 13 1 d returns of contribution to unapproved funds s.

Payer refers to an individualbody other than individual carrying on a business in Malaysia. It is proposed in Budget 2022 on 29 October 2021 that the foreign-sourced income of Malaysian tax residents which is received in Malaysia be taxed - effective from 1 January 2022. And b thereafter where the members funds of such co-operative society as at the first day of the basis period for the year of assessment is less than seven hundred and fifty thousand ringgit.

1 In the event of an appeal by a person who considers himself aggrieved by any assessment under Schedule A if it is proved to the satisfaction of the Special Commissioners by whom the appeal is heard or the Judge by whom the appeal is reheard that the annual value on. You are entitled to tax exemption not exceeding three times in a year for leave passage within Malaysia and one leave passage outside Malaysia not exceeding RM3000. Payment need not be from the employer - tips paid to waiter.

Free Hotel Accommodation In accordance with tax treatment Michelle is liable under Section 13 1 c of ITA 1967 which requires her to pay taxes for hotel accommodation provided by her current employer. Annual Defined Value. Types of employment income section details s.

13 1 b benefits in kind s. There will be a transitional period from 1 January 2022 to 30 June 2022 where FSI remitted to Malaysia will be taxed at the rate of 3 on gross income. A any wages salary remuneration leave pay fee commission bonus gratuity perquisite or allowance whether in money or otherwise in respect of having or exercising the employment.

Perquisites received can be in cash or in kind. A Public Ruling is published as a guide for the public and officers of the Inland Revenue Board of Malaysia. FSI remitted to Malaysia will be taxed at the prevailing tax rate from 1 July 2022 onwards.

1 Subject to this section income tax charged for each year of assessment upon the chargeable income of a person who gives any loan to a small business shall be rebated by an amount equivalent to two per cent prorated per annum or such other rate as may be prescribed from time to time by the Minister on the outstanding balance of the loan before any set off is made under. It sets out the interpretation of the Director General of Inland Revenue. Perquisites received can be in cash or in kind.

Withholding tax is an amount withheld by the party making payment payer on income earned by a non-resident payee and paid to the Inland Revenue Board of Malaysia. 13 1 c value of living accommodation s. A in respect of a period of five years commencing from the date of registration of such co-operative society.

If it is received in. 1 Leave Passage Vacation time paid for by your employer in two categories. Income Tax Act 1967.

If the payer fails to do so the amount which he has failed to pay and the applicable penalty will be a debt due from him to the Government. Further the payment is subject to Monthly Tax Deduction MTD when the payment is made to the employee or hisher previous employer. B Taxed under Section 131e of the Income Tax Act 1967 ITA a Sum received at the end of an employment contract or retirement age.

Assessment by reference to annual rent. Section 138A of the Income Tax Act 1967 provides that the Director General is empowered to make a Public Ruling in relation to the application of any provisions of the ITA. B an amount equal to the value of the use or enjoyment by the employee of any benefit or amenity not being a benefit or amenity convertible into money.

A statutory obligation is imposed on the payer to deduct or withhold the tax due from the payee. 13 1 e compensation. Such payment made on behalf of the employee is considered as a perquisite to the employee and is treated as gross income from employment under Section 131a of the Malaysian Income Tax Act 1967.

Malaysia Makes The Cybersecurity Top 10 With Some Help From Its Friends Bloomberg

Hr Guide Tax Clearance Letter Form Cp22 And Form Cp22a

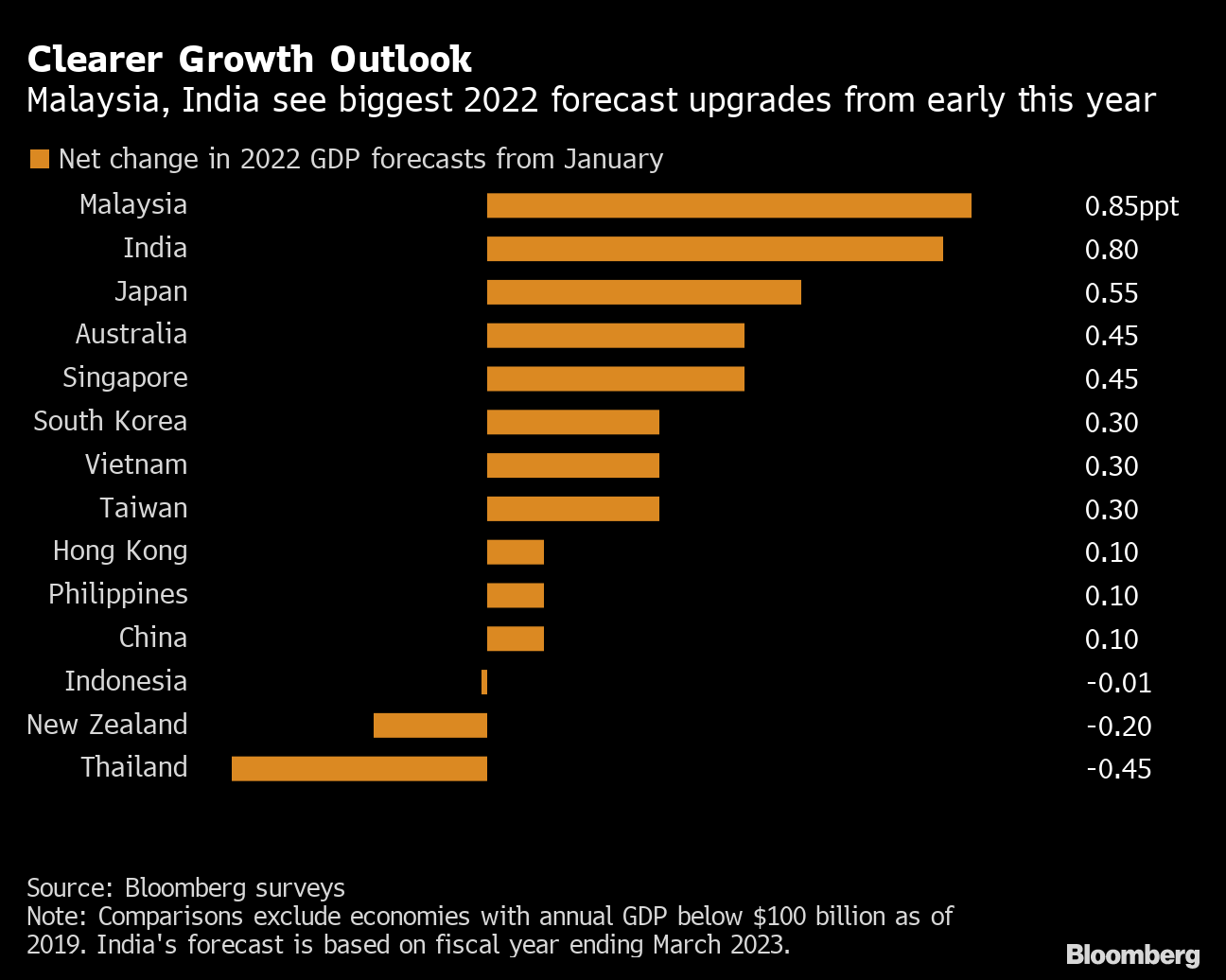

Malaysia India Top Asian Forecasts For Faster Growth In 2022 Bloomberg

Difference Between Wire Transfer Swift And Ach Automated Clearing House First Time Home Buyers Buying Your First Home Home Financing

Standard Deduction 2020 2021 What It Is And How It Affects Your Taxes Wsj

Covid 19 The Enhanced Wage Subsidy Programme Bdo

Income Tax Teeth Grinding Income Tax Tax Deductions Income Tax Return

Building Contractor Appointment Letter How To Create A Building Contractor Appointment Letter Download This Building C Lettering Letter Templates Templates

Economy Of Malaysia Economic Outlook History Current Affairs Malaysia Economy Outlook

Covid 19 The Enhanced Wage Subsidy Programme Bdo

- resepi mee kari secret recipe

- kain lace simple

- contoh kad kahwin arwah

- rumput laut kering nori

- air gula dan maag

- produk kecantikan new zealand

- design rumah banglo tradisional

- how to check ptptn status

- pelabuhan tanjung pelepas sdn bhd

- formula luas lilitan bulatan

- raja amin raja mokhtar

- makna perkataan whose

- azan e maghrib in islamabad

- logo jabatan pendidikan melaka

- gambar api mewarnai

- cuti negeri sembilan 2018

- rumah modern persegi panjang

- tulisan yang cantik di word

- tunku alang reza tunku ibrahim

- undefined